Lefdal Mine Datacenter looking to accelerate growth

LEFDAL MINE DATACENTER LOOKING TO ACCELERATE GROWTH – PROCESS FOR SHARE ISSUE PARETO SECURITIES HIRED AS FINANCIAL ADVISOR IN THE PROCESS

Lefdal Mine Datacenter AS (LMD) has in 2018 and so far in 2019 installed 10 MW of data center capacity. LMD has proven to the market the capability of implementing a TIER III certified design with a unique low investment per MW. The design approach is industrialized, and has a built-in flexibility that makes it possible to accommodate variations in both power requirements per unit, as well as different quality requirements/Tier levels. The capacity in LMD is almost unlimited due to the existing size of the facility and the high volume of hydropower production in the area. To accelerate growth and enable investments needed in related infrastructure, LMD has hired Pareto Securities to explore possible new investors for LMD.

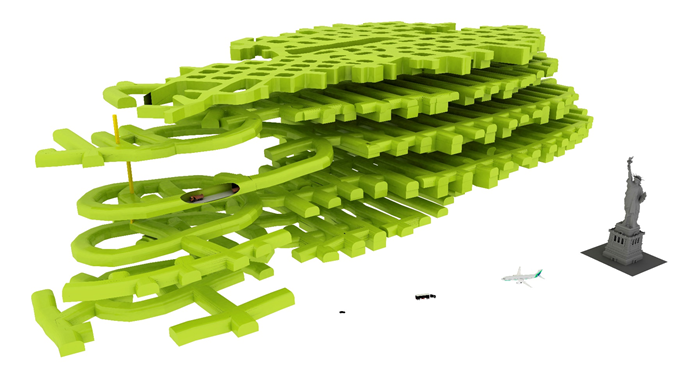

The main housing solution is 40 feet IT containers. LMD place the containers on both side of the streets. The streets are 17m high, enabling LMD to have 3 containers on top of each other.

The data center market is growing fast. Expected CAGR for the global wholesale co-location market from 2019-2024 is 15.7% with an expected turnover of $30 billion in 2024. Total market will increase with about 1,000 MW or 730,000 m2 of whitespace per year. Europe as market will see the highest relative increase together with APAC.

The Nordic countries are well suited for data centers due to the countries vast resources of renewable energy, low power prices, favorable climate conditions, good infrastructure as well as a skilled workforce. This has resulted in a surge of foreign investments over the past years. Companies such as Apple, Facebook, Google and Amazon (AWS) have made large investments in the hyperscale and cloud segment. The increased demand for High Performance Computing (HPC), i.e. artificial intelligence, makes LMD’s efficient and high- capacity water-cooling particular relevant in these fast-growing market segments.

The mine consists of six levels divided into 75 chambers with a potential white space area of 120.000 m2. The entry point leads to a 2 000 meters long access road, “the Spiral”, which is 14 meters wide and 8.5 meters high. The Spiral gives access to each floor level. LMD has built out Level 3 in Phase 1 and will later build out Level 2 (Phase 3) and Level 4 (Phase 2).

Current owners of LMD are regional technology investors 50.7%, Dr. Friedhelm Loh (Rittal/IDS) 33.3% and Sogn og Fjordane Energi (SFE) 16%.

“We have built and operate one of the leading data centers in the Nordics. Market demand is increasing, and we see that our solution is future proof. High densities, renewable power, low operational costs and increased demand for security are all trends that lead capacity to LMD. The current financial structure limits the speed of growth. We now wish to accelerate the build out of infrastructure and customer intake says Sindre Kvalheim, CoB at LMD. The board and owners have decided to hire Pareto to explore possible investors says Sindre Kvalheim.”

The containers are transported to the designated area with an electrical vehicle.

For more information on the share issue process, please contact Pareto and Lars Ove Skorpen at +47 91323115 or lars.ove.skorpen@paretosec.com – www.paretosec.no.

For information about LMD please contact Sindre Kvalheim at +47 97401400 or sindre.kvalheim@local-host.no – www.lefdalmine.com.

Best regards,

Sindre Kvalheim

CoB – Lefdal Mine Datacenter AS

Mobile: +47 974 01 400

E-mail: sindre.kvalheim@local-host.no

The Data Halls are always 12 meters wide and 4 meters high. They wary in length from 30 to 70 meters. Space/capacity can be rented in pods from 20 racks up to entire halls, 300 m2 to 800 m2.

Lefdal Mine Datacenter AS

LMD – The Norwegian Solution – is a unique mountain hall facility on the West Coast of Norway. It is one of the most cost effective, secure, flexible and green datacenter solutions in Europe. With a unique scalability, renewable power at leading low cost, a water-based cooling solution allowing up to 50 KW/rack with a PUE of less than 1.15 and low construction costs the facility is ideally positioned for current and future demands in the data center market.

The facility is Uptime Tier III Design certified and can offer one of the most secure datacenter solutions in the Nordic market. Current owners are:

Regional Technology Investors RTI – 50,7%

The regional investors have an offspring from a technology cluster based in Måløy. The cluster are involved in data centers, video conferencing, shipyards and marine technology and export.

Rittal has developed specially designed containers tailor-made for LMD. The containers consist of server racks, raised floor, LCP’s, PDR racks and network racks. They are available in different sizes – 6 to 12 server racks – with densities from 5 to 30 kW/rack. They can be adapted in N+1 or N+N environments. Standardization ensures high quality, lower price and short delivery time.

Rittal/IDS – Professor Friedhelm Loh – 33,3%

Professor Friedhelm Loh owns a group of companies that provide software, products and services to a range of industries including switchgear manufacturing, power distribution, steel and plastics. Today, the group has 11,500 employees, 78 global subsidiaries and annual revenue of around €2.2 billion. The largest company in the group, Rittal, supplies enclosures, climate-control technology, power distribution gear and IT infrastructure. In 2013, Friedhelm Loh Group acquired Cideon AG and Kiesling Maschinentechnik – companies active in software and engineering. Professor Friedhelm Loh serves as honorary president of ZVEI, a German electronics and electric manufacturers’ association. iNNOVO Data Systems (IDS) is owned by Rittal/Professor Friedhelm Loh.

Sogn og Fjordane Energi – 16%

SFE (Sogn og Fjordane Energi) is a publicly owned utility company. SFE plays an important role in the Norwegian power industry. They own or rent 24 power plants producing 2500 GWh renewable power in the region of Lefdal Mine Datacenter. In addition, they are a broker for several smaller power plants. They are also responsible for the regional grid – 4 000 km. SFE is an owner enabling Lefdal Mine Datacenter to offer optimal power solutions and power prices for end clients. Annual revenue of around $200 million NOK.

Norway as data center location

Norway has a 98,5% share of renewables in its power production. One foresees a significant surplus in the production and extremely competitive price forecasts for the years to come. Long term power prices in Norway are expected to be the lowest in the Nordics.

The Norwegian Government has recognized the potential data center market and have over time invested public sector resources towards enabling the Norwegian Datacenter Industry to grow into an international, commercially attractive solution that will generate an increase in Direct Foreign Investment for the Norwegian Economy.

Norway provides a unique proposition to satisfy a growing international marketplace for large scale Data centers, IT Hosting Services and International Cloud Delivery Centers:

- Abundant renewable power, strong grid and world leading long term power prices

- Competitive tax regime, strong economy, competent workforce

- Stable political situation

- EU-compatible framework

- Credit ranked no. 1 in the world

- Ranked 6th worldwide on “ease of doing business”

- Ranked 2nd worldwide in the Cushman & Wakefield 2016 Data Center Risk Index

Pareto Securities

Pareto Securities is an independent full-service investment bank with a leading position in the Nordic capital markets and a strong international presence within the energy sectors. Pareto Securities is headquartered in Oslo, Norway, with more than 500 employees located in offices in Norway, Sweden, Denmark, Finland, United Kingdom, Germany, Switzerland, USA, Singapore and Australia. In addition to being recognized as a leading player in the primary and secondary equity markets, Pareto Securities has the largest fixed income team in the Nordic region dedicated to high yield bonds, holding an undisputed position as the number one investment bank in terms of market knowledge and placing power.